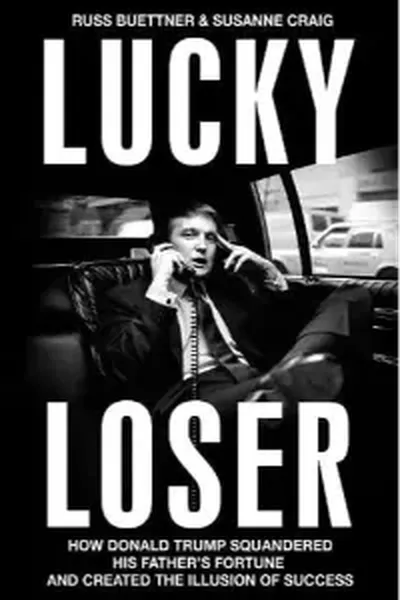

Another day, another indictment. The latest charges against Donald Trump do not involve paying hush money to a porn star or conspiring to subvert the 2020 election. They appear in a new book which strikes at the heart of the Trump myth: the notion that he is a self-made billionaire who personifies the American dream.

Lucky Loser, an exhaustive study of Trump’s business record, suggests exactly the opposite. Trump owed everything to his father Fred, one of the country’s top housebuilders who made his fortune in the post-second world war construction boom. With a couple of exceptions, Trump’s own casino and real estate deals veered between indifferent and disastrous.

In every instance, owning or having an option on trophy assets beat building profitable businesses. Trump was going nowhere fast until he debuted as the blowhard host of NBC’s The Apprentice — a gladiatorial management contest filmed inside his gilded tower on Fifth Avenue. The show skyrocketed in the ratings, providing Trump with a financial lifeline and a platform for his successful campaign for the White House in 2016.

Lucky Loser draws heavily on previous exposés by the authors, New York Times journalists Russ Buettner and Susanne Craig. Digging through mountains of tax records, they discovered that Trump paid $750 in federal income tax in 2017, the year he became president. In 2008, he paid no federal income taxes during a year in which he collected $14.8mn from The Apprentice and $18.5mn from celebrity endorsements and licensing deals. In fact, Trump paid no federal income tax in 11 of the 18 years they examined.

Buettner and Craig’s work earned them a Pulitzer Prize, along with David Barstow, but the impact on Trump’s fortunes was akin to peanuts bouncing off a rhinoceros hide. He still refused to hand over his tax returns until ordered to do so by the US Supreme Court in 2021. Lucky Loser therefore often has the feel of a rematch, timed to puncture the Republican candidate ahead of the presidential election in November.

There are sharper portraits of Trump, the relentless self-promoter who combines animal cunning with whiny narcissism. By far the best is Too Much and Never Enough, written by his niece Mary Trump, a trained psychologist. The story of Trump allegedly pushing aside his alcoholic older brother Freddie Jr — Mary’s father — to take over the Trump real estate empire is a Cain and Abel drama. In Lucky Loser, it comes across a little tame.

In their opening foray, Buettner and Craig blame Trump’s grip on the popular imagination on Americans’ awe of celebrity. “Our tendency to conflate the trappings of wealth with expertise and ability. Our eagerness to believe people of apparent status will not lie to us. Our inability to distinguish the fruits of hard work from those of sheer luck.”

A more uncomfortable conclusion is that the US tax system is rigged in favour of privileged insiders like Trump. True, the authors show how Fred Trump benefited from the favourable mortgage terms that the New Deal-era Federal Housing Administration provided to developers. They also lay out the tax dodges that allowed Fred to funnel millions to his princeling son. Trump has been equally adept in gaming the system.

Lucky Loser shows how media credulousness fuelled Trump’s rise. Time and again, journalists swallowed his claims of huge wealth. Fawning profiles appeared regularly in print and on air. The New York Times itself was hardly immune, but even Mike Wallace of CBS’s 60 Minutes, supposedly the toughest interviewer on the block, swooned in Trump’s presence.

The New York banks were equally gullible, lending freely on Trump’s personal guarantees. Wall Street only wised up after Trump’s casino empire collapsed in the mid-1990s, forcing a wholesale disposal of assets. Yet Trump escaped personal bankruptcy, allowing him to make a comeback as a reality TV star.

Unlike Trump’s gaudy casinos in Atlantic City, The Apprentice was a money gusher, thanks to product placement. Burger King, Domino’s, General Motors, Unilever — all the top consumer product companies appeared on the show. At one point, Trump was earning $1mn an episode from licensing and sponsorship deals.

In the show, the winning apprentice would receive $250,000 and a year’s placement in the Trump organisation. But once again, as the authors show, the image of success was an illusion. The reality was a skewed selection process and a capricious, bullying host.

As Jeff Zucker, boss of NBC News and Entertainment, admitted: “You were casting an actor . . . He was playing a part. We knew that. It’s called reality television, but it’s never real, per se.”

Until it was real. Donald Trump really did become the 45th US president. He really is running again for the White House. And if he makes it to the top again, somebody should write another book about the enablers who helped him on his way up, the people who looked away from the lies, and the system that allowed him to lead such a charmed life.

Lucky Loser: How Donald Trump Squandered His Father’s Fortune and Created the Illusion of Success by Russ Buettner and Susanne Craig Bodley Head £25/Penguin Press $35, 528 pages

Lionel Barber, a former editor of the FT, is author of ‘Gambling Man: The Wild Ride of Japan’s Masayoshi Son’

Join our online book group on Facebook at FT Books Café and subscribe to our podcast Life and Art wherever you listen