尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

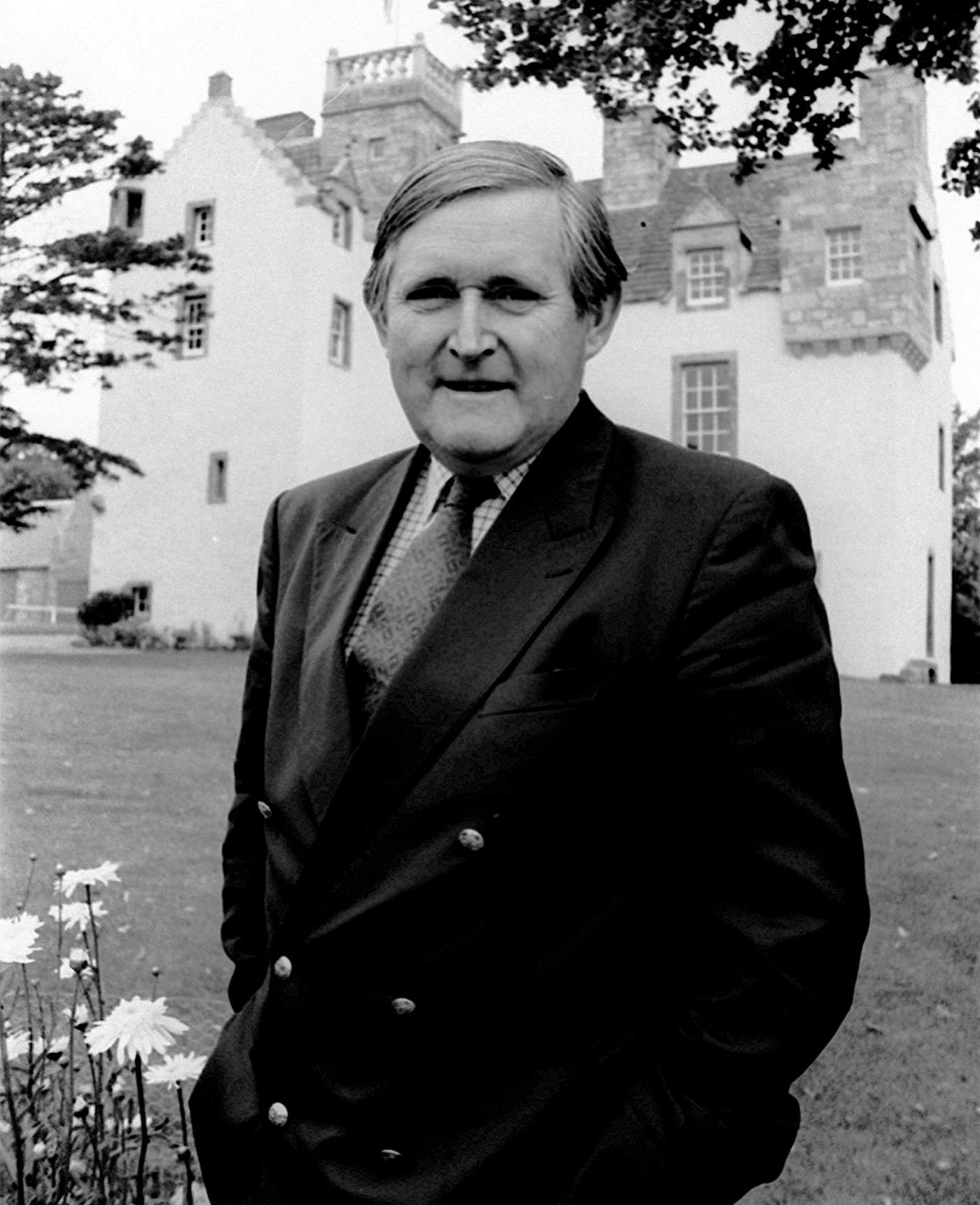

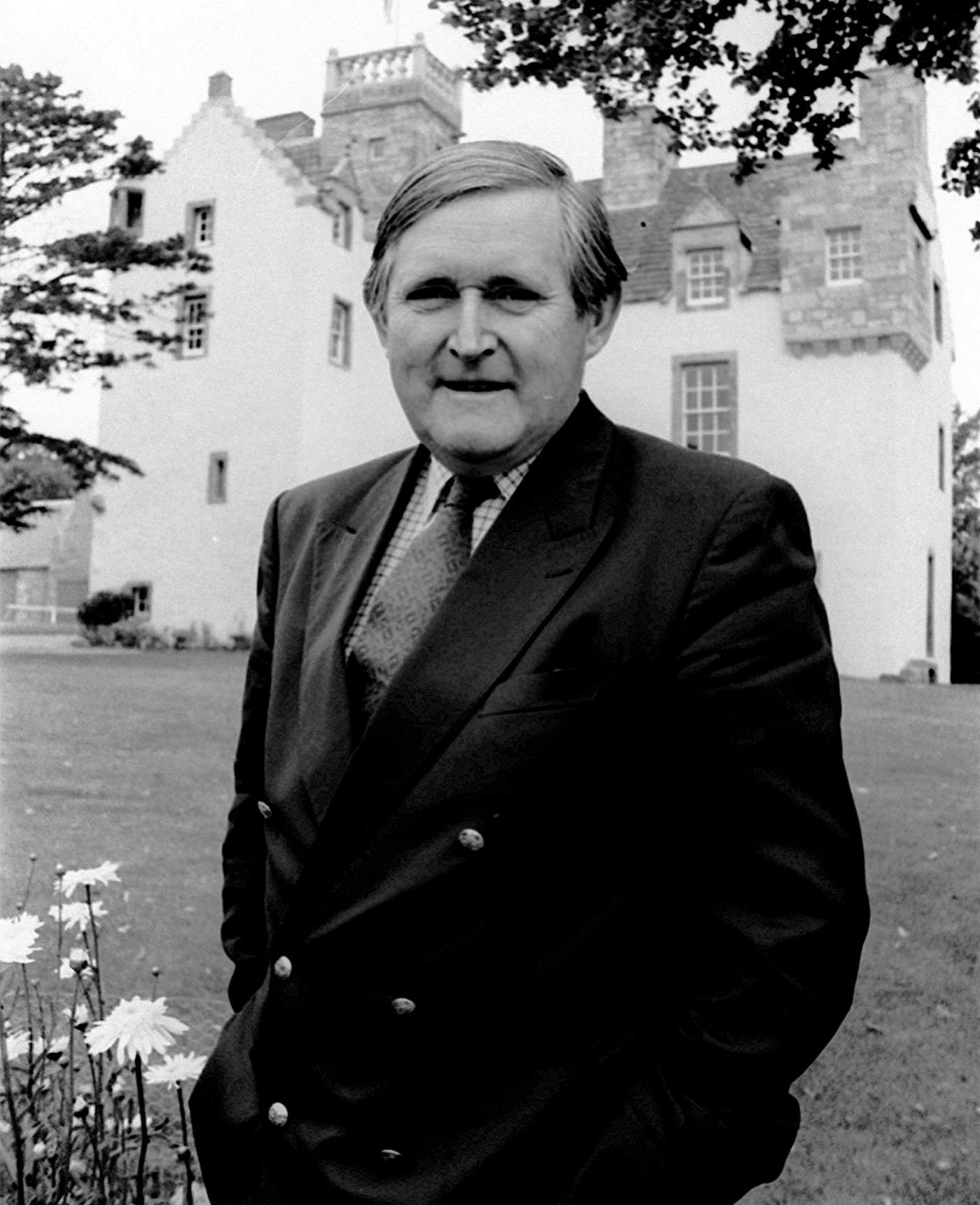

Sir Angus Grossart, merchant banker and patron of the arts, was for more than half a century an irresistible force in Scottish public life.

商业银行家、艺术赞助人安格斯•格罗萨特爵士(Sir Angus Grossart),在半个多世纪的时间里,一直是苏格兰公众生活中一股不容忽视的力量。

He described himself, half in jest, as a member of the “Scotia Nostra”, a man who wielded great influence: first through Noble Grossart, the boutique investment bank active in several epic UK takeover battles in the 1980s, including the “whisky wars” involving Guinness and Distillers.

他半开玩笑地称自己是“Scotia Nostra”的一员,这个人拥有巨大的影响力:先是通过操盘精品投资银行Noble Grossart,这家银行活跃于上世纪80年代英国的几场史诗般的收购战,包括涉及健力仕(Guinness)收购Distillers的“威士忌之战”。

The banker was a ubiquitous string-puller in the cultural world. He chaired or squatted on the board of all the major museums and galleries in Scotland, chaired a private auction house (Lyon & Turnbull), and contributed to numerous philanthropic causes. “Angus was a Renaissance man,” said Sir Ewan Brown, his long-time partner at Noble Grossart, “but he was also a street fighter when required.”

这位银行家是文化界无处不在的幕后操纵者。他担任过苏格兰所有主要博物馆和画廊的主席,担任过一家私人拍卖行(礼昂腾博Lyon & Turnbull)的主席,并为许多慈善事业做出了贡献。“安格斯是一个文艺复兴时期的人,”他在Noble Grossart的长期合作伙伴尤恩•布朗爵士(Sir Ewan Brown)说,“但在需要的时候,他也是一个街头斗士。”

One of three sons of a Lanarkshire tailor, Grossart, who has died aged 85, claimed his first business experience was selling reject factory toffee on a street stall. A junior golfing champion, he studied law at Glasgow University but soon found the bar to be “a little cloistered”.

享年85岁的格罗萨特(Grossart)是拉纳克郡一个裁缝的三个儿子之一。他声称他的第一次商业经验,是在一个街头摊位上拒绝销售劣质的工厂的太妃糖。作为青少年高尔夫冠军,他在格拉斯哥大学学习法律。作为一名初级高尔夫球冠军,他在格拉斯哥大学(Glasgow University)学习法律,但很快发现法律生涯“有点与世隔绝”。

In 1969, he co-founded Noble Grossart with Sir Iain Noble, a Scottish landowner and Gaelic language activist. Noble soon left with a half-a-million-pound buyout, but Angus retained the name, turning an initial £30,000 investment into well over £300mn

1969年,他与伊恩·诺布尔爵士(Sir Iain Noble)共同创立了Noble Grossart,后者是苏格兰土地所有者和盖尔语活动家。诺布尔很快就以50万英镑的买断价离开了,但格罗萨特保留了诺布尔的名字,把最初的3万英镑投资变成了3亿多英镑。

During the 1970s, the bank prospered through word of mouth and patient growth, driven partly by the discovery of North Sea oil, which revived animal spirits in Scotland. Grossart took a lucrative stake in the Wood Group, the oil services firm, and backed entrepreneurs such as Kwik-Fit’s Sir Tom Farmer, Stagecoach’s Sir Brian Souter and banker Benny Higgins.

在20世纪70年代,该银行通过口碑和低调发展而繁荣起来,部分原因是北海石油的发现使苏格兰的动物本能得到了恢复。格罗萨特在石油服务公司伍德集团(Wood Group)中获得了利润丰厚的股份,并支持Kwik-Fit公司的汤姆·法默(Tom Farmer)爵士、Stagecoach公司的布莱恩·索特(Brian Souter)爵士和银行家本尼·希金斯(Benny Higgins)等企业家。

Grossart never met a title he did not like, a source of trouble in 2018 when he accepted the Medal of Pushkin for services to the arts from Vladimir Putin. He reluctantly agreed to hand it back after Russia’s invasion of Ukraine.

格罗萨特从未遇到过他不喜欢的头衔,2018年,他从弗拉基米尔·普京(Vladimir Putin)那里获授普希金勋章(Medal of Pushkin),以表彰他对艺术的贡献,但这是当下麻烦的源头。在俄罗斯入侵乌克兰后,他勉强同意归还。

As someone who loved dressing up, his great regret was that, though awarded a knighthood, he failed to make the Order of the Thistle — the equivalent in chivalry of England’s Order of the Garter. The explanation probably lies in the sorry saga of the Royal Bank of Scotland.

作为一个喜欢打扮的人,他最大的遗憾是,虽然被授予了骑士头衔,但他没能获得蓟花勋章——相当于英格兰嘉德勋章的骑士勋章。原因可能在于苏格兰皇家银行(Royal Bank of Scotland)时的遗憾的韵事。

In 1981, when I first met him as a cub reporter on the Scotsman, Grossart led opposition to the Hong Kong and Shanghai Bank’s takeover of the Royal Bank. The “backwoodsman” (and they were all men) saw off the bid, arguing it would turn Scotland into a branch economy of the UK.

1981年,当我作为《苏格兰人报》的一名小记者第一次见到他时,格罗萨特作为领导,抵抗了汇丰银行对苏格兰皇家银行的收购意图。这些“庄稼汉”(他们都是男的)拒绝了汇丰的提议,认为这将使苏格兰变成英国的一个分支经济体。

Two decades later, the Royal Bank launched an audacious takeover of the larger NatWest bank. There followed breakneck growth under Fred “The Shred” Goodwin and the calamitous implosion of RBS in the 2008 global financial crisis. Grossart, vice-chair, got out just in time in 2005, but like a generation of Scottish businessmen who packed the RBS board, his hard-earned reputation for prudence never quite recovered.

20年后,苏格兰皇家银行发起了一项大胆的收购,收购规模更大的NatWest银行。此后,在弗雷德•古德温(Fred“The Shred”Goodwin)的领导下,该行实现了惊人的增长,却在2008年全球金融危机中发生了灾难性的内爆。2005年,副董事长格罗萨特及时离职,但就像苏格兰皇家银行董事会的一代苏格兰商人一样,他以谨慎行事而辛苦得来的声誉从未完全恢复。

Noble Grossart’s heyday was over, a victim of both Big Bang deregulation which favoured capital-rich international investment banks and Grossart’s reluctance to offer equity to high-performing employees. His parsimony was legendary. “At the end of the RBS board meeting, Angus would help himself to two Havana cigars, in addition to the one he was smoking,” recalled Sir George Mathewson, former chief executive and chairman.

Noble Grossart的全盛时期已经结束,它是两大因素的牺牲品:一方面是有利于资本丰富的国际投资银行的“金融大变革”(Big Bang)去监管化,另一方面是该集团不愿向业绩优秀的员工提供股权。他的节俭是出了名的。苏格兰皇家银行前首席执行官兼董事长乔治•马修森爵士(Sir George Mathewson)回忆道:“在董事会会议结束时,安格斯除了正在抽的那支雪茄外,还会给自己拿两支哈瓦那雪茄。”

But his generosity of spirit was notable, too. He was passionate about Scottish culture and history, from Sir Walter Scott to the Glasgow aesthetic movement, populating his private collection at home in Edinburgh and at Pitcullo Castle, a restored rural retreat in Fife.

但他的慷慨精神也值得赞赏的。他对苏格兰文化和历史充满热情,从沃尔特•斯科特爵士(Sir Walter Scott)到格拉斯哥的美学运动,他在爱丁堡的家中以及法夫的乡间别墅皮特库罗城堡都收藏了大量藏品。

Sir Jonathan Mills, former director of the Edinburgh Festival, said Grossart skilfully combined business acumen with an eye for the visual arts and a deep knowledge of his subject. His greatest triumph was perhaps as head of the Burrell Renaissance in Glasgow. He donated £1mn to a £66mn restoration of the eponymous museum and successfully pleaded for a change in the will (and the law), allowing the former Scottish shipping tycoon’s eclectic private collection to tour abroad.

爱丁堡艺术节前总监乔纳森•米尔斯爵士(Sir Jonathan Mills)表示,格罗萨特巧妙地将商业头脑、视觉艺术眼光和对主题的深入了解结合起来。他最伟大的成就或许是作为格拉斯哥伯勒尔文艺复兴的领袖。他捐赠了100万英镑,用于6600万英镑的同名博物馆的修复,并成功地请求修改遗嘱(和法律),允许这位前苏格兰航运大亨不拘一格的私人收藏出国展览。

This was Scotland in his own image: confident, outward-looking and determined to leverage its heritage. He celebrated this tradition in Gleneagles every December at “Scotland International”, a private gathering of 60 prominent figures from academia, the arts, business and the odd retired spy. Politicians were not welcome. “I belong to two parties,” he liked to say, “the Grossart party and the dinner party.”

这就是他心目中的苏格兰:自信、外向,并决心利用自己的传统。每年12月,他都会在格伦伊格尔斯(Gleneagles)的“苏格兰国际”庆祝这一传统,这是一个由60位来自学术界、艺术界、商界和古怪的退休间谍的知名人士参加的私人聚会。政客们不受欢迎。他喜欢说:“我属于两个派,格罗萨特派和宴会享乐派”。

Grossart never spoke on the vexed question of Scottish independence or the SNP’s record in power, but privately bemoaned the stifling of initiative and the “conspicuous” absence of non-political voices in contemporary Scotland. “Many follow, few lead,” he concluded, wistfully.

格罗萨特从未就苏格兰独立或苏格兰民族党执政记录这一棘手问题发表过言论,但私下里对当代苏格兰主动性的压制和非政治声音的“明显”缺席表示遗憾。他踌躇满志地总结说:“追随者众多,领导者太少。”